Peerless Info About How To Reduce Tax In Canada

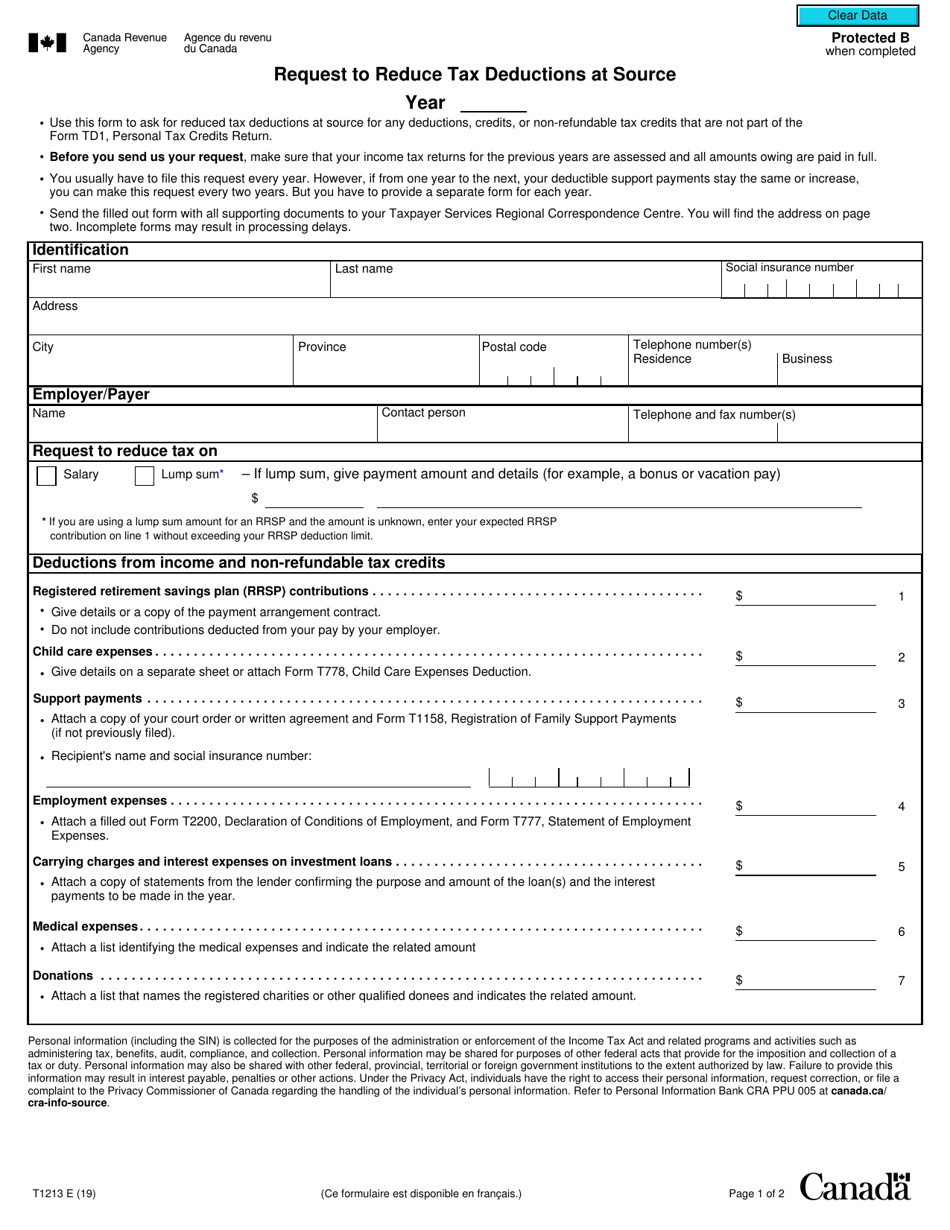

Employee's province of employment is not the same as their province of residence and they will have too much income tax deducted;

How to reduce tax in canada. Here are 12 ideas. Later, when the funds are withdrawn from the lower income spouse’s rrsp, the tax obligation on the rrsp withdrawal may be lower as it is taxed at the lower income. Your taxable income is your income after various deductions, credits, and exemptions have been.

Having separate personal and business accounts. The annual limit is 18%. The ccpa’s alex hemingway modelled a wealth tax that includes three brackets, beginning at one per cent above $10 million, rising to two per cent above $50.

2024 federal income tax rates. Key takeaways like most other places, if you live or earn income in canada, you will have to pay income tax. Carrying charges, interest expenses and other expenses.

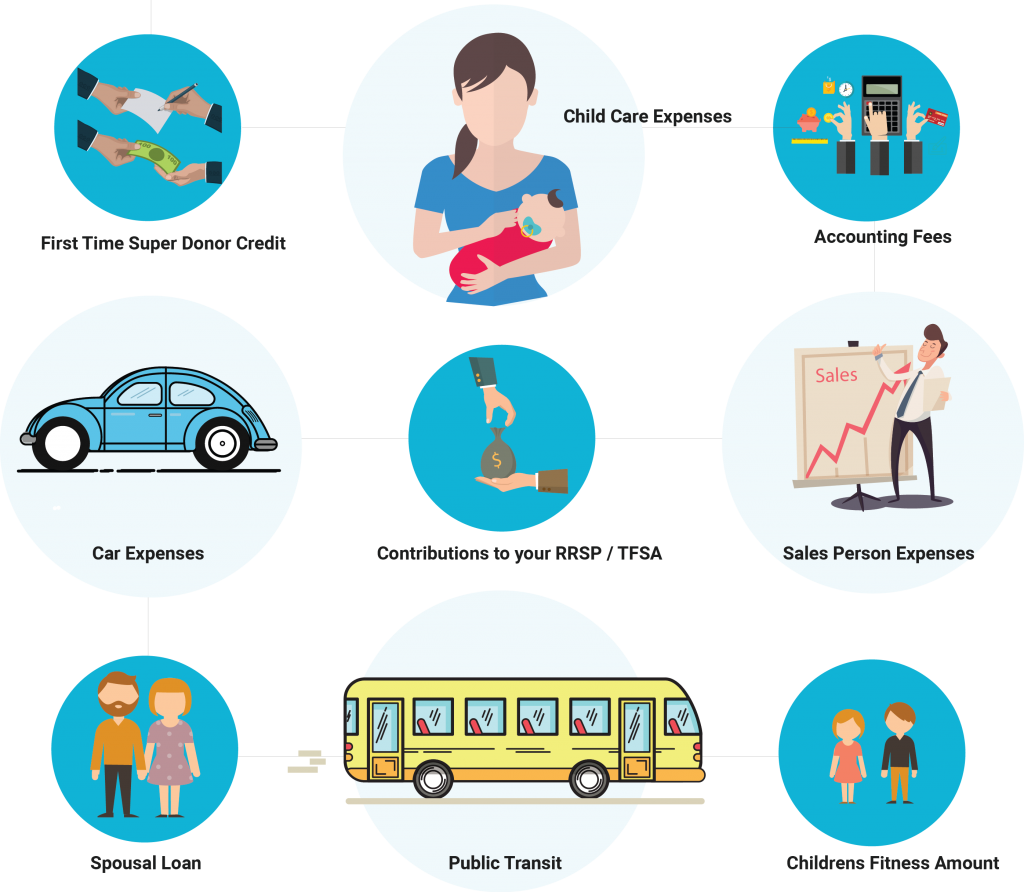

Canadian tax law allows for several ways to reduce. Here are a few ideas: A tax credit in canada directly reduces the income tax you must pay.

Tax schemes are plans and arrangements that attempt to deceive taxpayers by promising to reduce the taxes they owe, either through large deductions, or through promising tax. The tax will slide to zero between. The cra allows a pensioner to split the canada.

Government announced a 20 per cent tax on profit made by people who sell properties two years or less after purchasing. Profits you generate from selling assets you’ve had for a. Contributing to rrsps one way to reduce taxable income is to maximize your registered retirement savings plan (rrsp) contribution each year.

If you suspect tax evasion, you can report suspected. Make the most of registered accounts. Small and growing businesses will also.

Contributions to a registered retirement savings plan are deductible and can significantly reduce your taxable income. For example, a $1,000 tax credit can directly be applied to lower the tax you need to pay by. For many, the biggest annual tax break comes from contributions to their registered retirement savings plan (rrsp).

If you want to learn how to reduce taxes in canada, you should consider income splitting, i.e. If your tax returns are processed after this date, your payment will be included in a subsequent payment after your return is assessed. We’ll do even better for you, friend — here are six ways to avoid capital gains tax.

These rates apply to your taxable income. If you’re generating more profit than you need to live on,. Here are a few ways to lower your tax bill with a clear conscience.