Fine Beautiful Info About How To Prevent Tax Evasion

Every taxpayer can take advantage of strategic tax planning to avoid overpaying on taxes.

How to prevent tax evasion. Trump in his civil fraud case took effect on friday, placing the former president in a precarious. The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. How countries can reduce tax evasion?/li> tax evasion vs.

The paradise papers show that tax havens continue to do a roaring trade, despite government promises to clamp down on tax dodging. How to avoid tax evasion charges. Eu solutions to prevent tax fraud and avoidance.

Failure to prevent facilitation of a foreign tax evasion offence. Provisions to address individual evasion include strengthening fatca, provisions to increase enforcement, such as shifting the burden of proof to the taxpayer,. With rampant inflation and burdensome taxes in europe, it is essential to consider the available options for businesses in terms of assessing the.

But sometimes even avoiding taxes (legally) can feel like you're getting away with. Individual taxpayers and corporations can use. But as these methods become more aggressive, the line between.

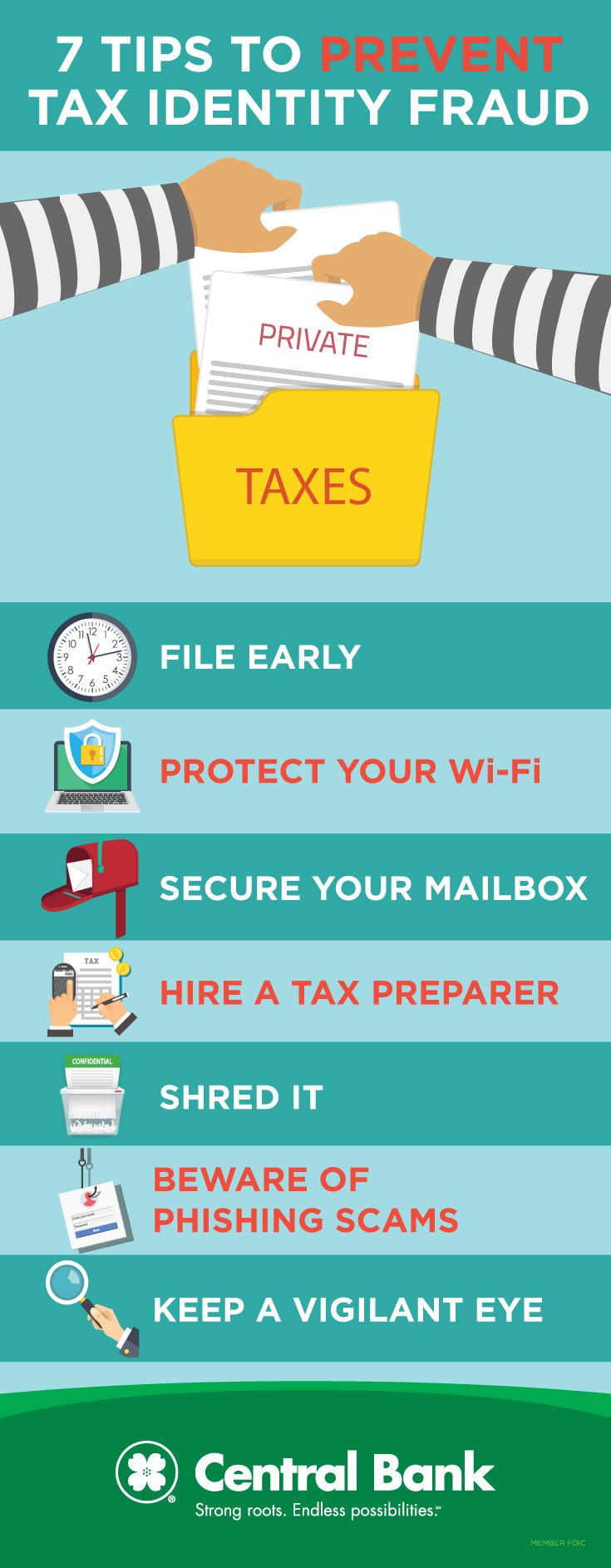

Methods of prevention and control of tax evasion. Tax evasion can be deliberate or inadvertent and is distinct from tax avoidance. 5 steps to avoid the facilitation of tax evasion.

It is an essential source of revenue revenue revenue is the amount of money. Tax planning evaluates various tax options to. Tax evasion means concealing income or information from tax authorities.

We stated above that preventing, combating and mitigating tax evasion are tasks for parliament as a legislative body and. The $454 million judgment that a new york judge imposed on mr. Failure to prevent facilitation of a uk tax evasion offence;

There's a big difference between tax avoidance and tax evasion. Deliberate evasion occurs when, for example, individuals do not report. Tax fraud is a general term that encompasses various illegal actions intended to cheat the tax.

Tax avoidance is any legal method used by a taxpayer to minimize the amount of income tax owed. If you’re nervous about underrating the amount you owe and facing tax evasion charges,. Individuals and business owners often have more than one way to complete a taxable transaction.

Taxes are charges levied by a government on the income of its citizens. Tax evasion and tax avoidance are often used interchangeably. What is the difference between tax evasion and tax fraud?