Nice Info About How To Pay Off High Interest Rate Credit Cards

Say you owe $10,000 on your credit card with 18% apr.

How to pay off high interest rate credit cards. Now that it's clear that paying off your balance transfer before the 0% rate expires should be a priority, it's time to map out a timeline. This credit card payoff calculator also recommends. Use wallethub’s credit card payoff calculator to calculate how long it will take to pay off a balance and how much it will cost.

The most effective way to pay off multiple credit cards is by paying a lump sum toward one of the debts and only the minimum on the other. With payments of $500, it would take 24 months to pay off your debt with $1,978.27 in total interest paid. For $25 a month, they consolidate the debt into one lump sum and get negotiated lower interest rates.

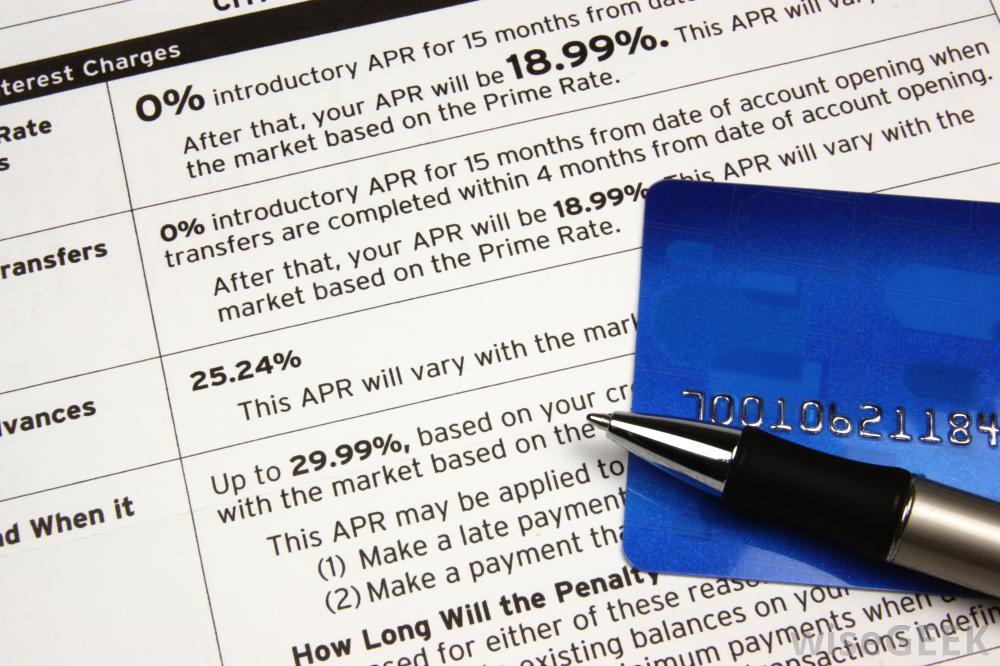

If you currently have credit card debt, moving it over to a balance transfer credit card will give you a long time to pay down your debt at 0% interest — typically a. If your minimum payment is 3%, you'll take a little over 25 years to pay off your balance. Assess your debt & make a plan.

0% introductory apr on balance. No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. The first step to solving any problem is to acknowledge it fully.

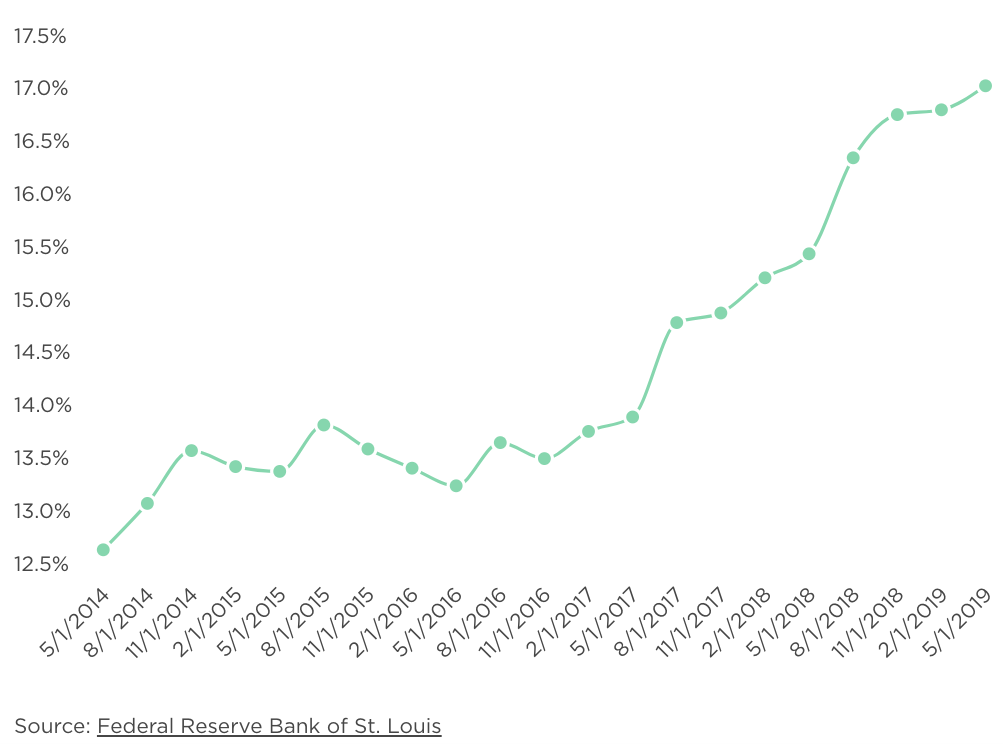

Make one monthly payment and pay off the debt in. Negotiate a lower interest rate. if you noticed that your interest rate has increased (which will make it harder for you to pay off over time), you may be able to contact your credit card. Pay off credit cards or other high interest debt.

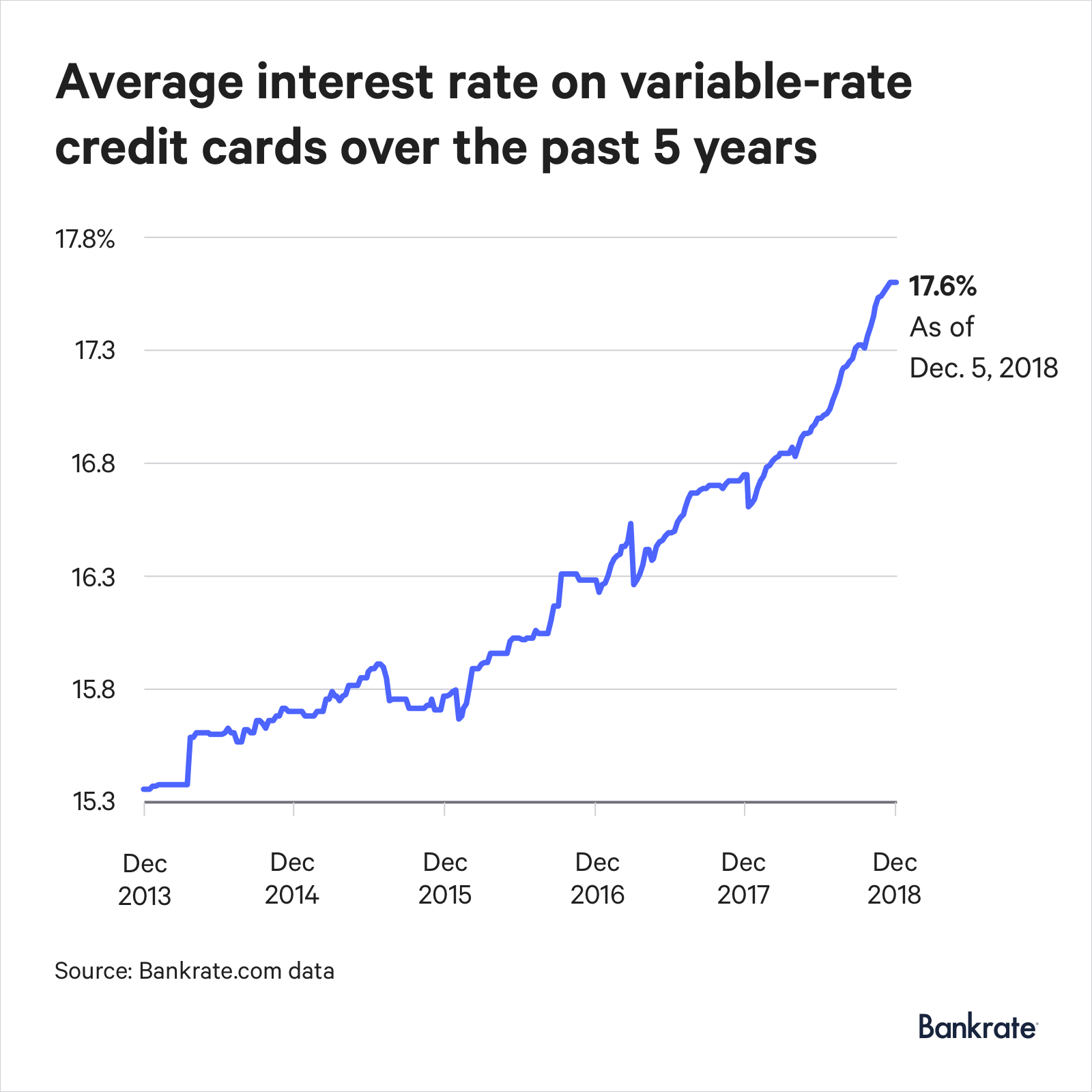

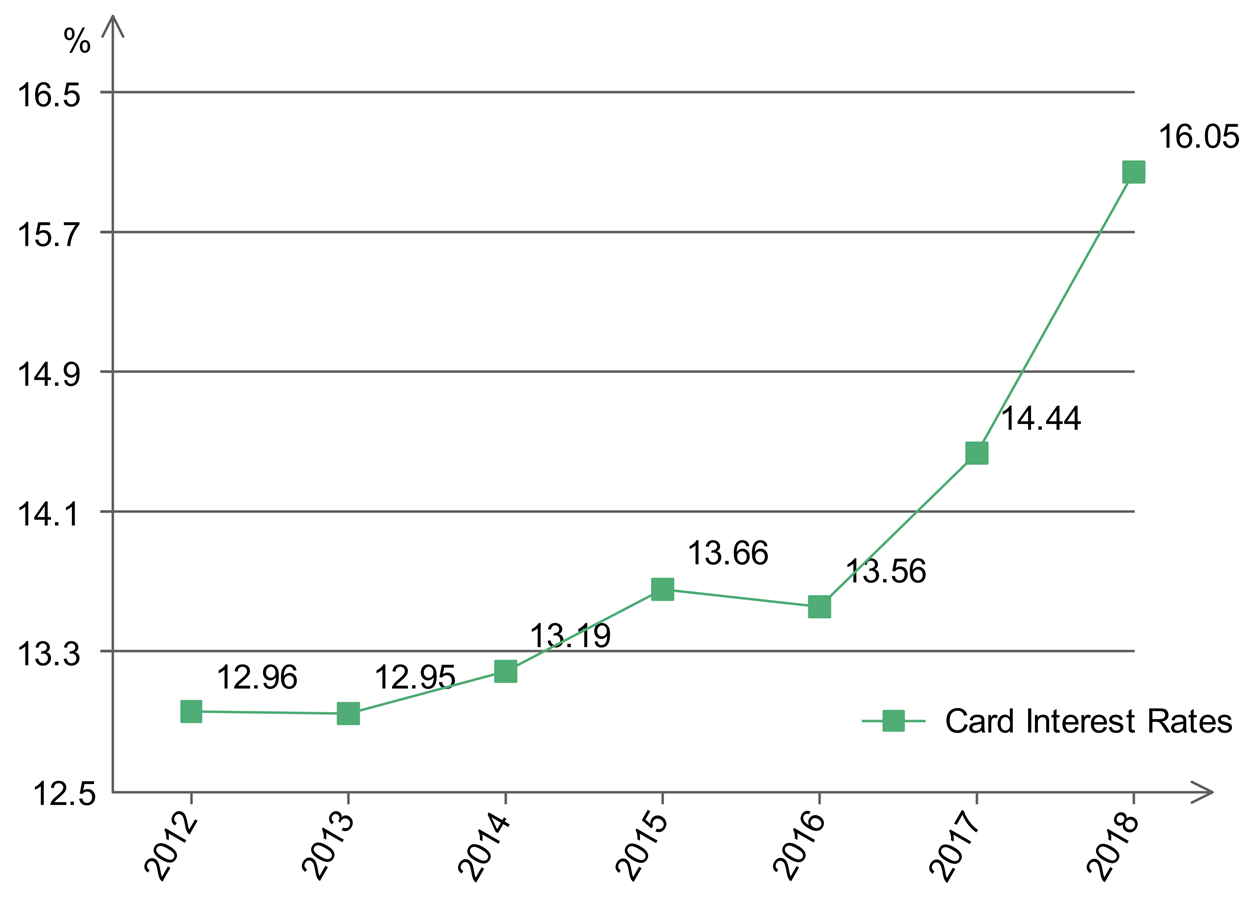

You’ll also decrease your debt faster since the interest fees will. Most credit cards charge high. Using a balance transfer credit card.

Paying off the smallest balance first. Using a credit card with a high interest rate can become costly if you don’t pay off your balance. You can avoid crushing interest rates by.

One of the easiest ways to stop incurring credit card interest is to move your debt from your current card to one with a 0% apr offer for balance transfers. You can't have good credit if you. Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances.

If you pay off credit. 5%, with a $5 minimum. Here’s when you should and shouldn’t close it.

Use cash or debit. Who this strategy is good for: If you want to reduce the balance faster, but can't afford to substantially increase your monthly payments, try the following:

/detail-of-credit-card--studio-shot-140193373-5a8f94ef119fa80037e64d77.jpg)

![Average Credit Card Interest Rates [Statistics by Issuer, Card Type]](https://upgradedpoints.com/wp-content/uploads/2022/02/Average-Credit-Card-Interest-Rates-by-Issuer.png)

:max_bytes(150000):strip_icc()/GettyImages-148249133-5c58bf7bc9e77c000159b1a2.jpg)