Cool Tips About How To Pay For Kids College

How to talk to your kids about paying for college.

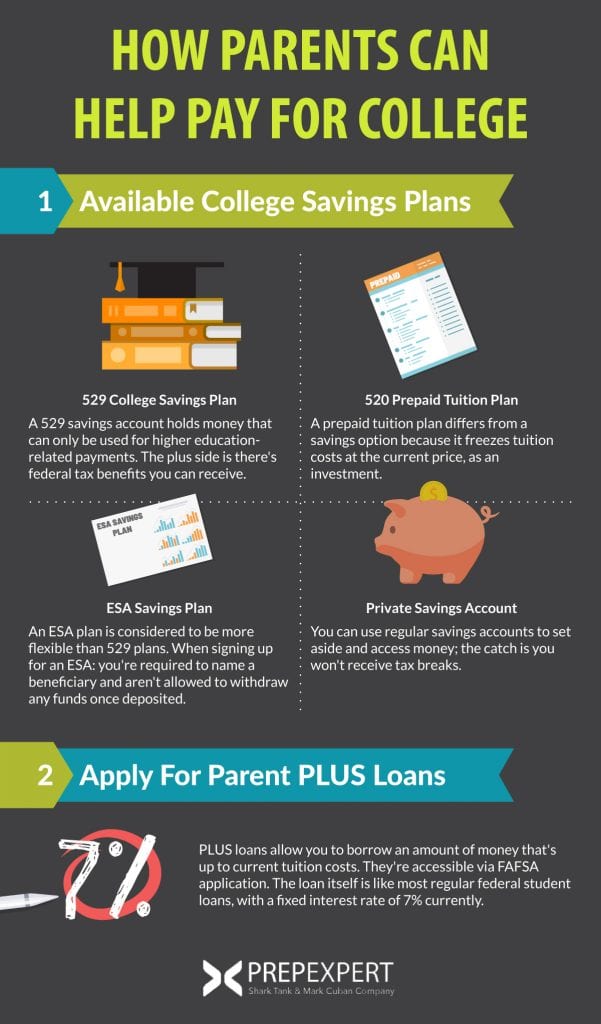

How to pay for kids college. Students who are single and earned more than the $12,950 standard deduction in tax year 2022 must file an income tax return. Pay for your kid’s college? The idea of a 529 college savings plan is great:

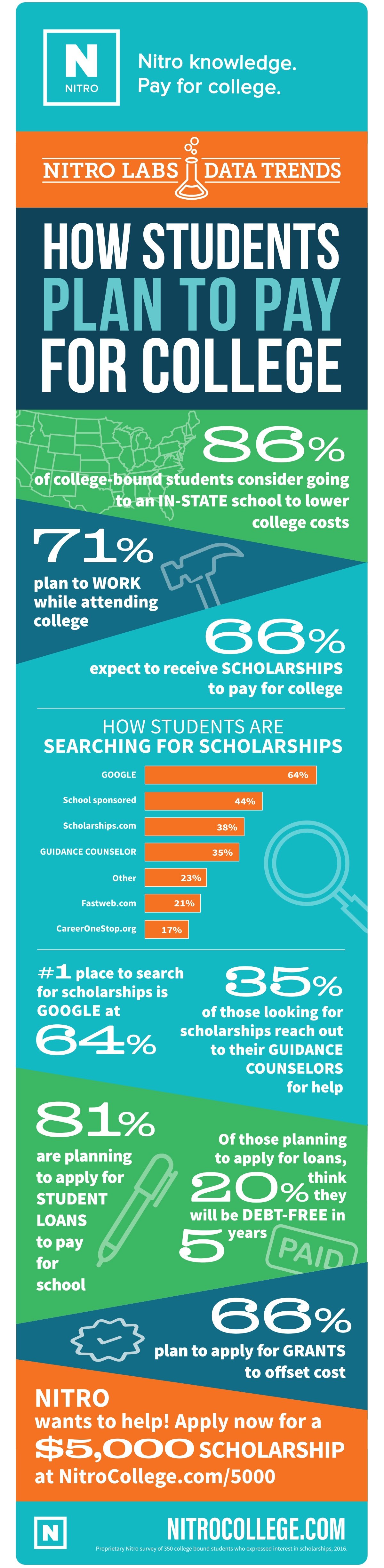

Don’t take on college debt for your child if your financial health will suffer when your kid doesn’t pay the bill. Some parents feel it’s their duty to cover the cost of their child’s college education. Here are 10 steps you can take to learn how to pay for college:

College keeps getting more expensive. Here’s a look at some arguments in support of that viewpoint. Arizona 529 plans have a maximum contribution limit of $531,000 for each beneficiary.

How will paying for your child's college impact your retirement? When students who cannot afford to pay tuition or accept. Have a realistic goal in mind.

Nine in 10 undergraduate university students. If you are secure with. Buying a complete set of tools for a specialist role can cost anywhere from $8,000 to $30,000 or more.

One of the first steps experts recommend to families concerned about how to pay for college is to complete the free application for federal student aid, called the. How to talk to your kids about paying for college. The best time to start working on paying for your child’s college education is shortly after the child is born.

Before you put money into. How to pay for college: Fourteen winners will get $529 toward an az529 education savings account.

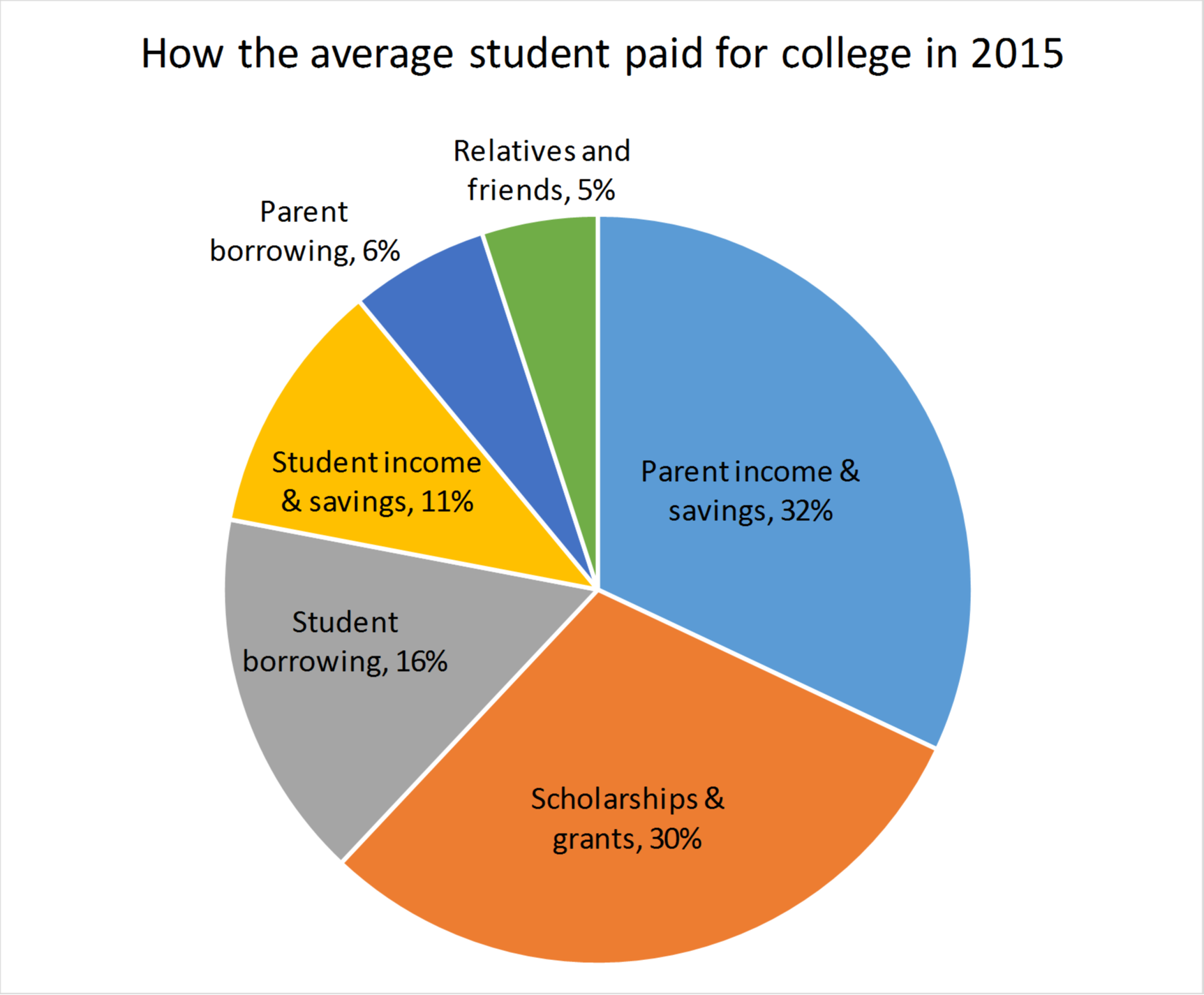

While bond ladders sound complex, they’re actually quite simple. Though there are loans for college, there aren't any for retirement. You can use the cash inside universal or whole policies to pay for anything, including tuition.

You can contribute money into an account and it will grow tax free to someday pay for your child's education. Giving your child a head start.

![How People Pay for College [2020] Financing Statistics](https://educationdata.org/wp-content/uploads/2020/10/how-students-fund-their-own-college-education-2.png)