Have A Info About How To Keep Track Of Your Expenses

Our subscriptions needed an intervention.

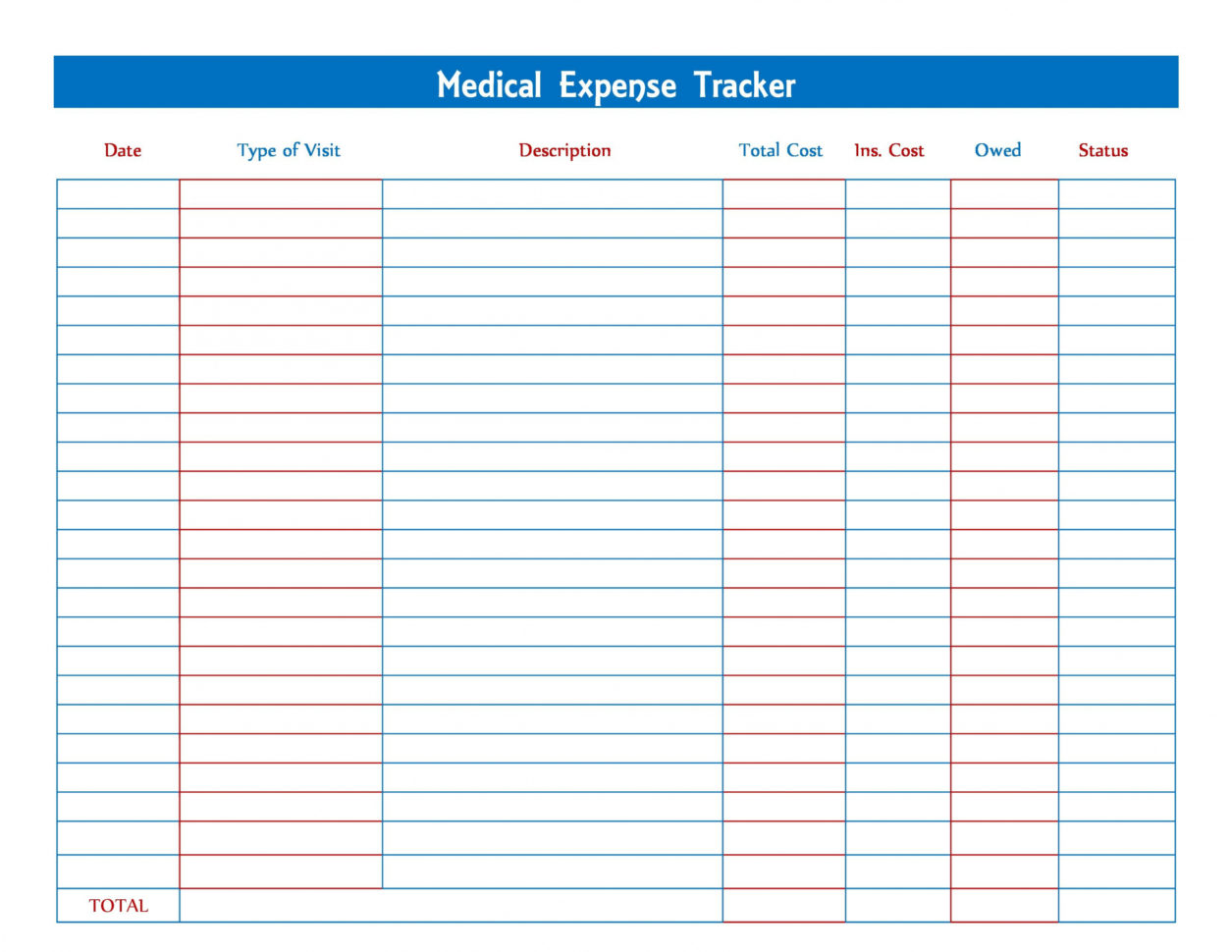

How to keep track of your expenses. How to track business expenses in 5 steps step 1: These are divided into two broad. 6 ways to track monthly expenses 1.

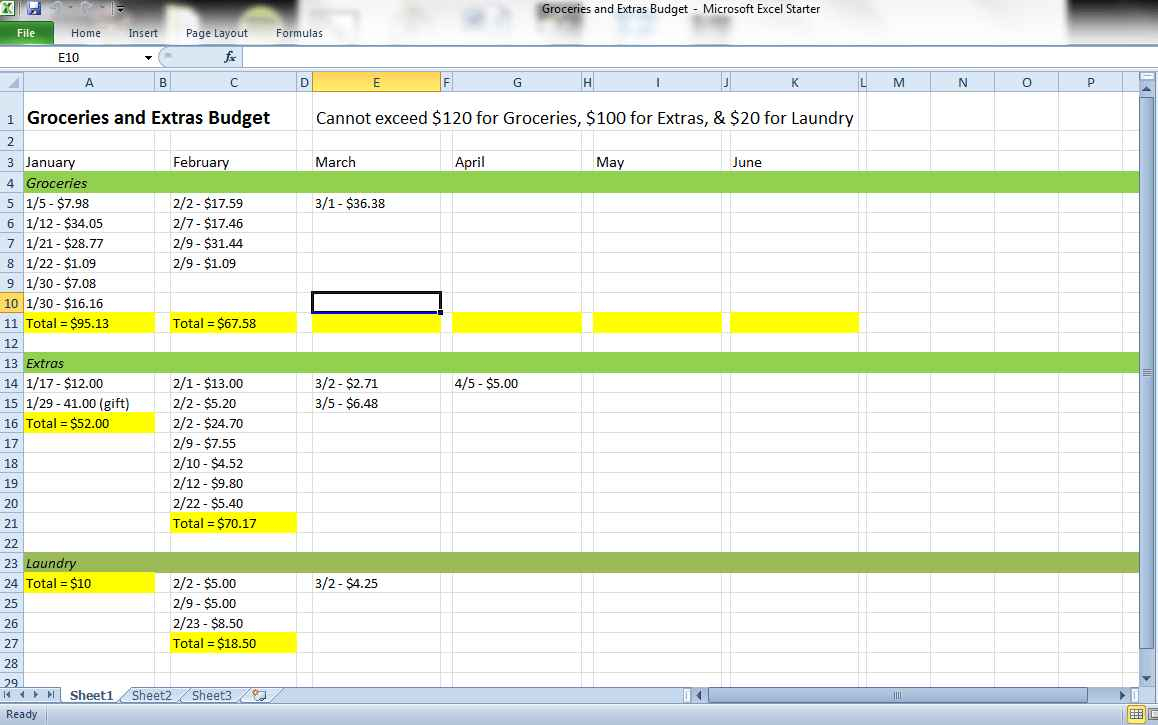

Track your expenses regularly step 3: Begin by grouping your expenses into different categories. Here are a few ideas for building a better system for tracking expenses to help get you started.

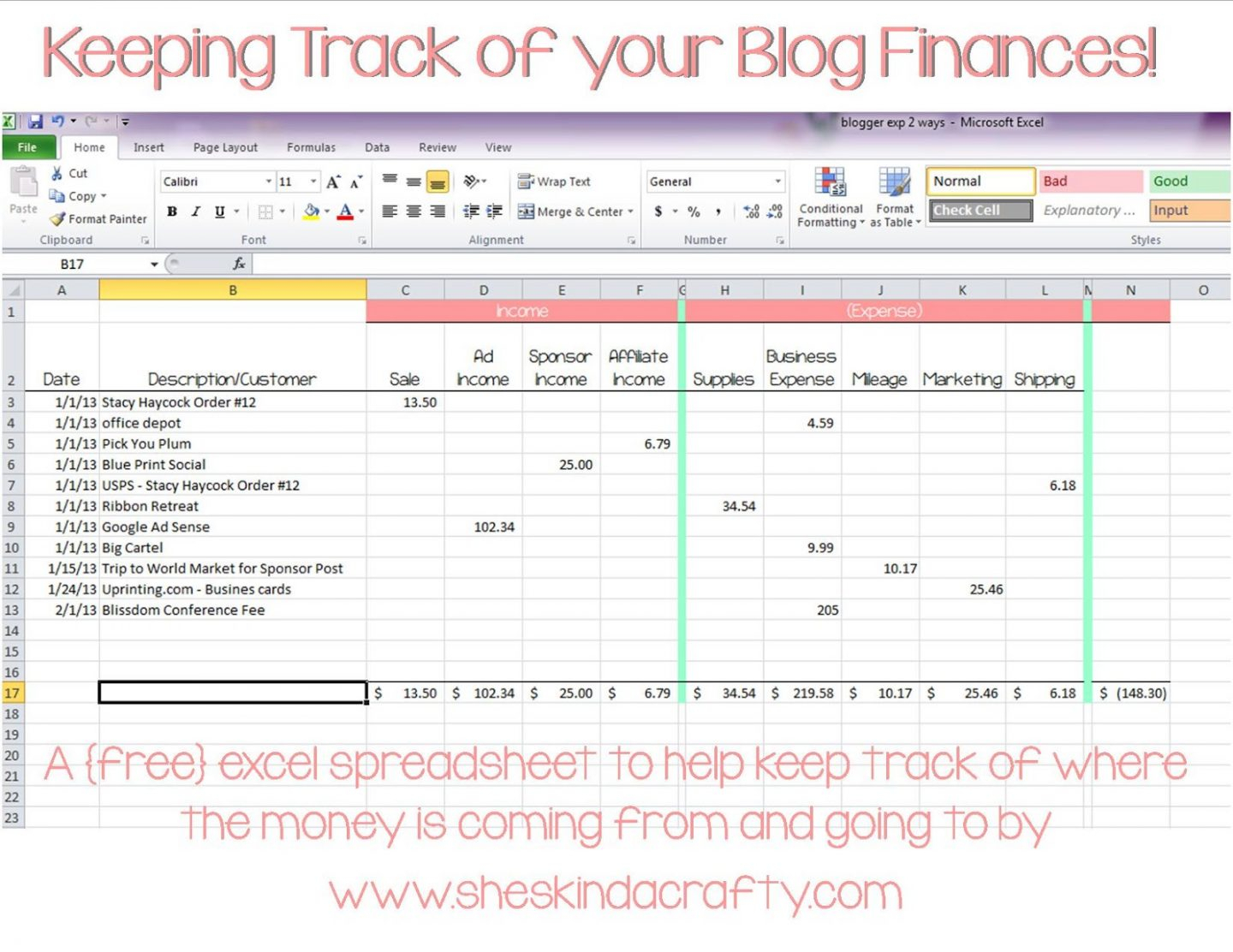

Set aside dedicated time at consistent intervals to assess your financial situation. Take advantage of budgeting templates if you haven’t created your own spending spreadsheet yet, you can just make a copy of someone else’s spreadsheet. Get a business bank account and credit card as you get started in business, a separate business bank account seems like the least of your worries.

Pinpoint your money habits by taking inventory of all of your accounts, including your. Maximising the use of a single platform keeps both the process and the data as clean as possible. It starts by understanding and mastering your cash flow.

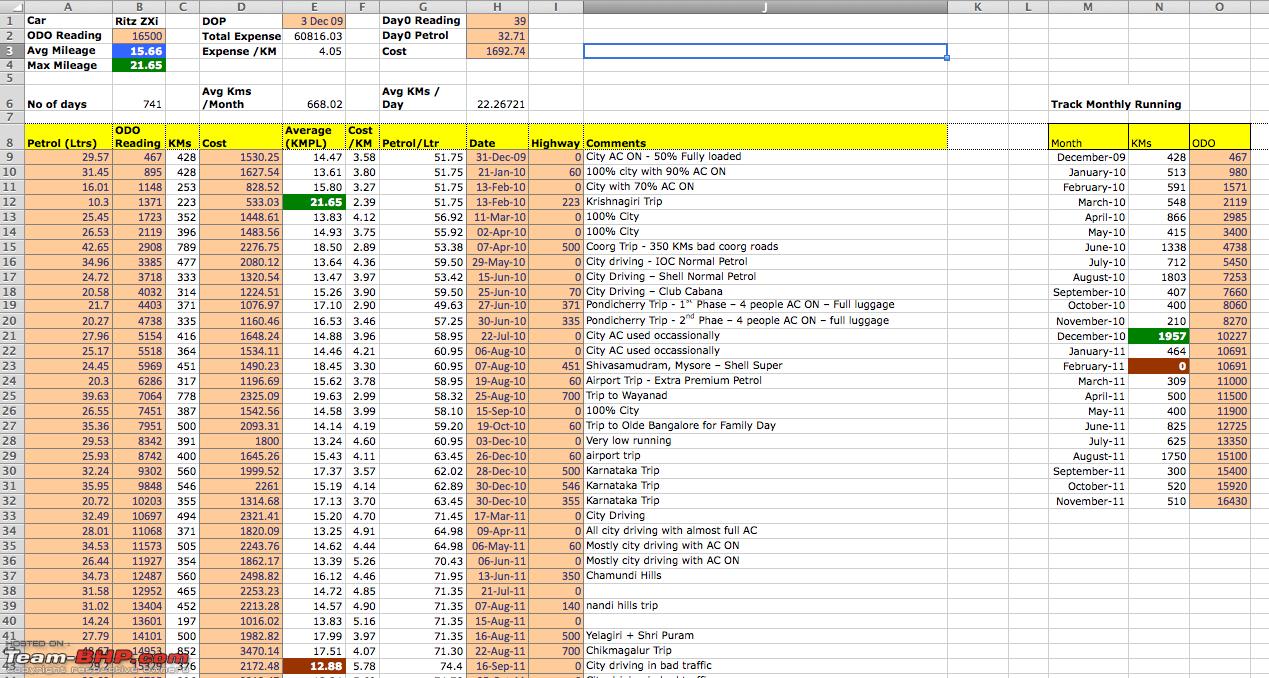

Founded in 2015, everlance is an app designed to track mileage, expenses, and receipts. Here's how you can track your business expenses: The first step to keep track of business expenses is to create a business.

Advanced accounting and bookkeeping with tax management features. Keep a thorough paper trail step 4: Stay on top of your receipts.

Tracking your spending is often the first step to getting your finances in order. Take control of your finances with spendee: Open a business bank account choose an appropriate accounting system choose cash or accrual accounting.

Record expenses by logging receipts, incoming invoices, and other business. Track as you spend the most active approach: Here are the six steps we used to get out of subscription hell and cut our expenses by about $190 a.

When you download the app, you automatically start a seven. As you incur expenses, input them into the appropriate category along with the date and amount spent. Carry around a notebook and pen wherever you go, writing each transaction as you spend.

Keep track of your expenses, manage your income, and create custom. Create a business bank account. We’ve covered most of the do’s here, so now let’s look at the.