Inspirating Info About How To Claim Vat Uk

Vat, a consumption tax placed on a product whenever value is added at each stage of the supply chain, can significantly impact your business's cash.

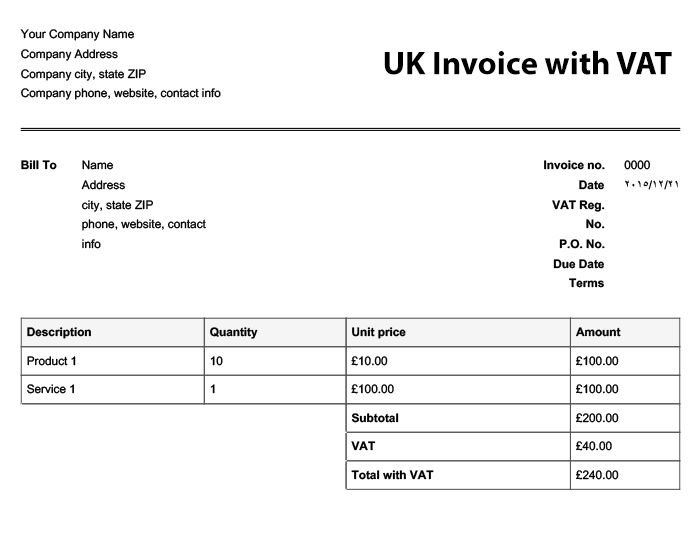

How to claim vat uk. The first step is to register for vat online. Standard vat rate of 20%: You can only reclaim vat on tax deductible expenses used specifically for your business.

How to claim vat back in the uk: The uk has three different vat rates, depending on the types of goods and services being supplied. In general, you have up to four years.

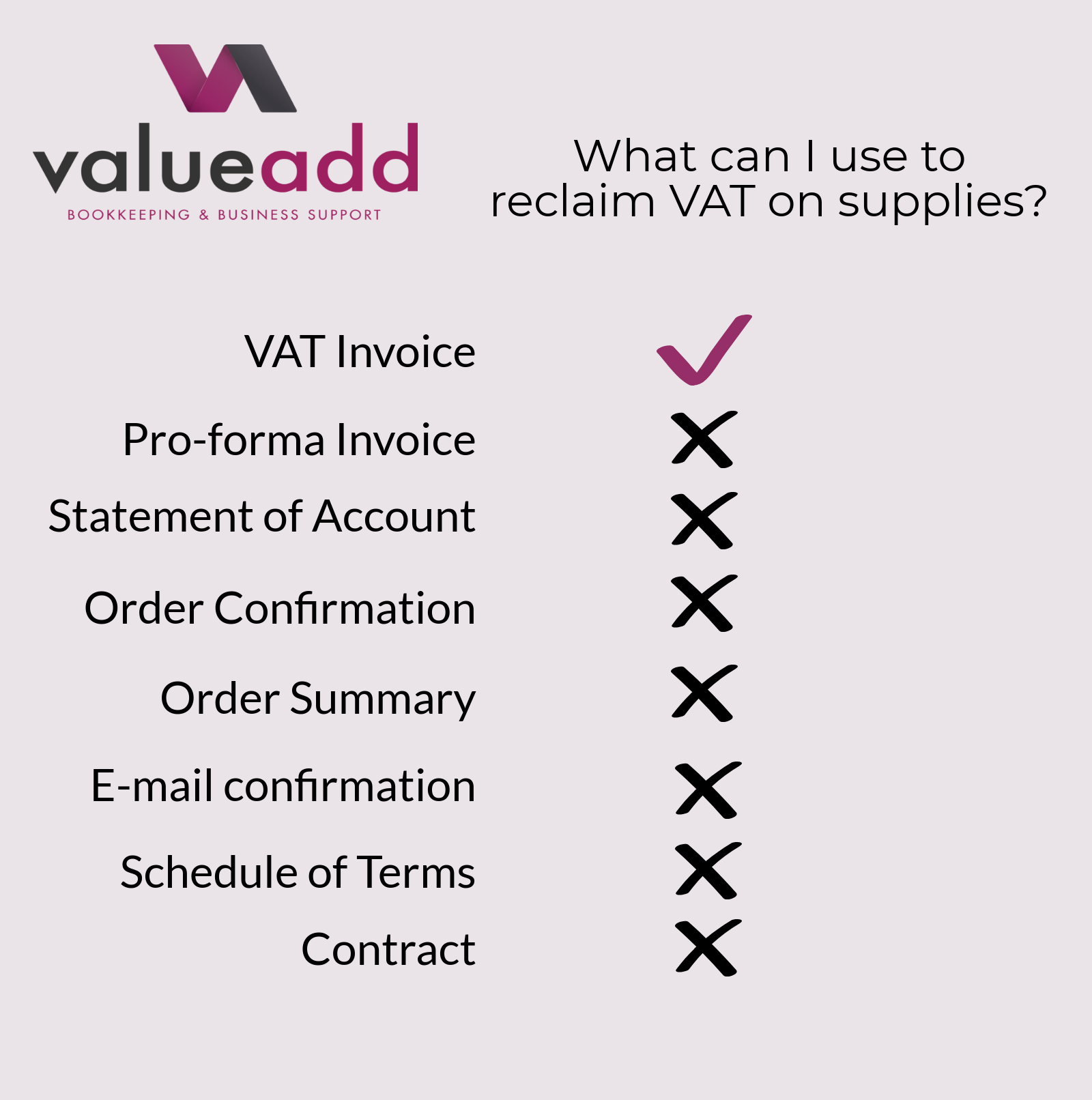

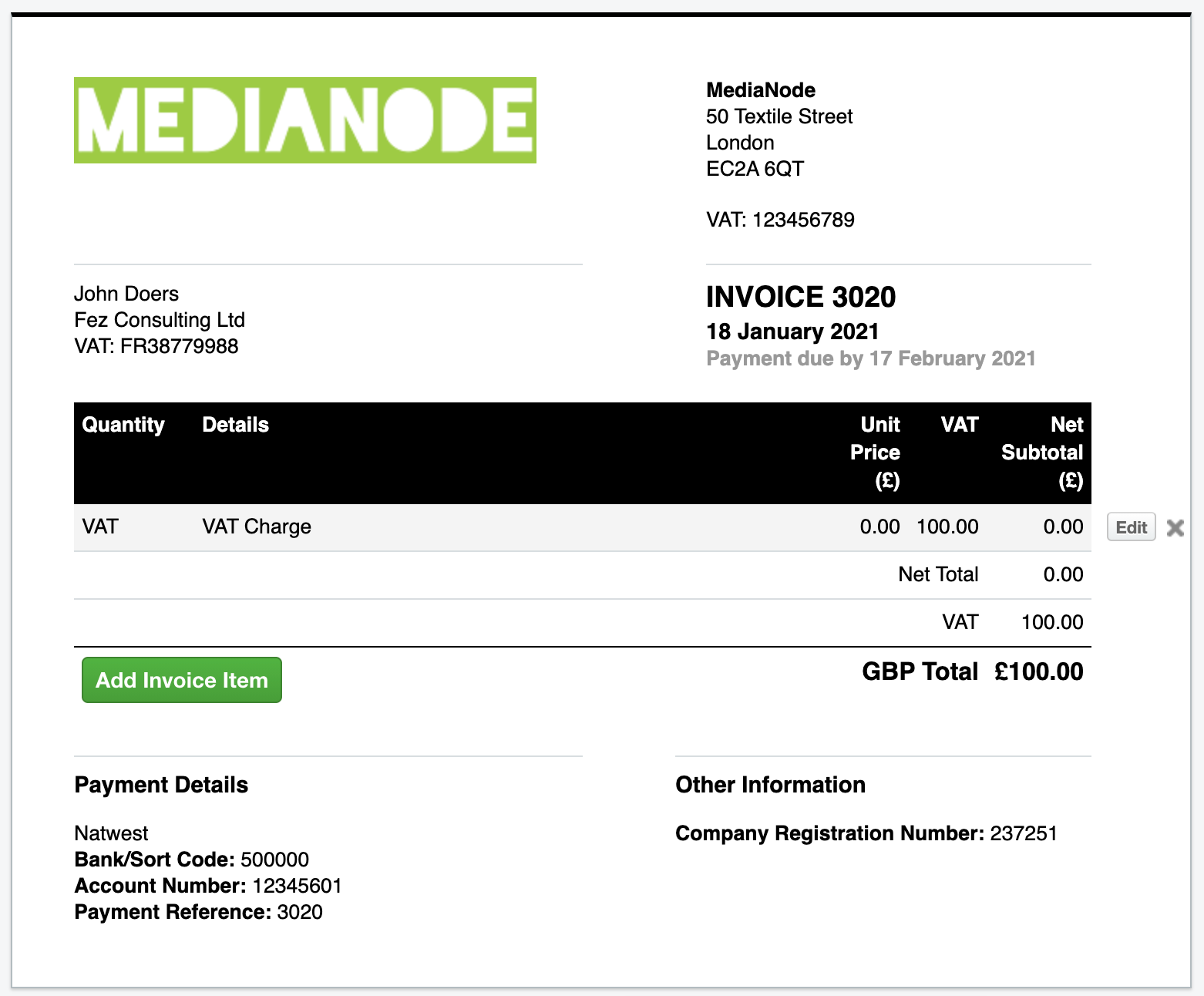

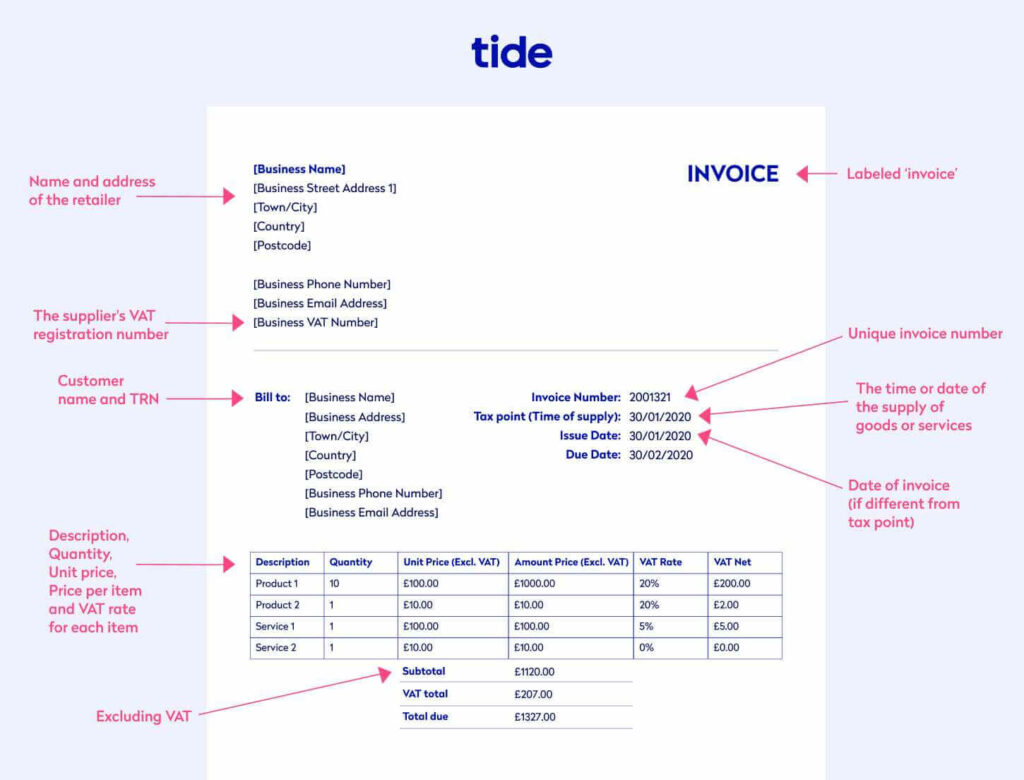

The three rates are as follows: A unique invoice number the date of supply a description of the goods or services the total amount payable the amount of vat charged as mentioned, there's a. When you can claim vat back you can.

What we do. Your national insurance number an identity document, like a passport or driving licence your bank account details your unique taxpayer reference ( utr ), if you have. The tax, which you pay when you buy goods and.

If you are a vat registered user in uk, you can claim your vat for the goods & services you. Can i claim vat back on online purchases? What can you reclaim vat on?

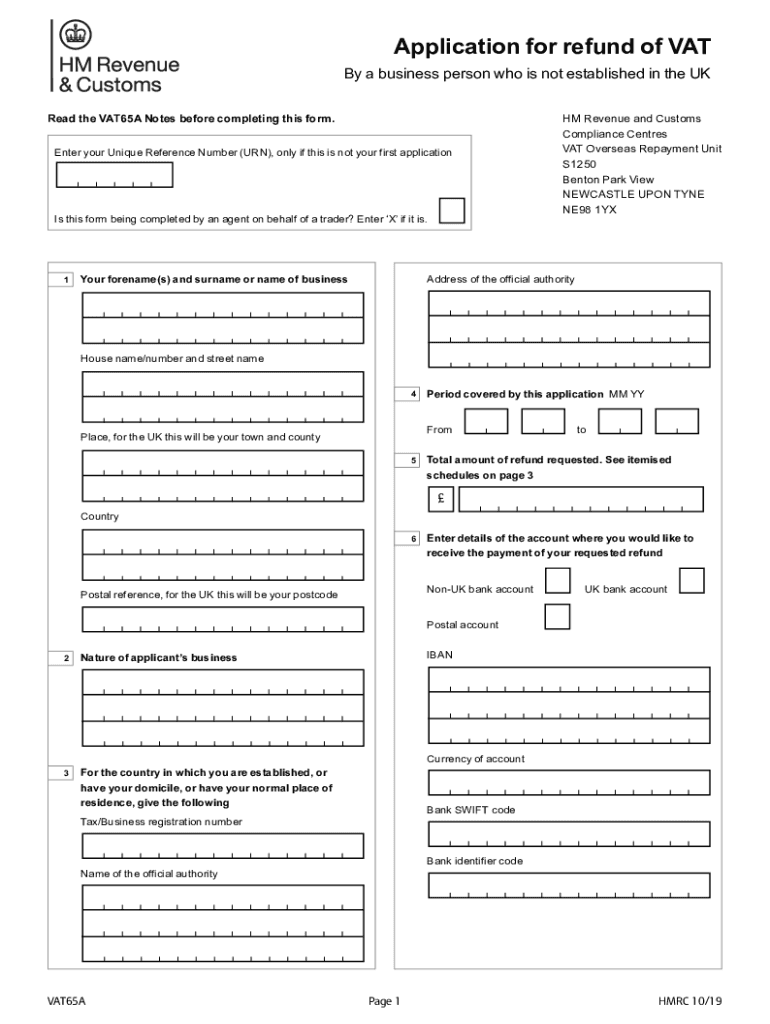

This notice explains how businesses established in countries outside of the uk can reclaim vat incurred in the uk and that uk and isle of man businesses can. These are all questions tax officials in the uk have had to wrestle with in the 51 years since vat was introduced. When it comes to vat reclaim in the uk, businesses established outside of the uk can claim vat on goods and services.

Most goods or services that a business uses to make vat exempt. Any items used ‘ solely ‘ for private or personal use (including business entertainment costs). When it comes to your vat claim, businesses have a limited term in which they can claim back vat paid on eligible costs.

Key is understanding administration of vat and how to make claims. Which goods and services are reclaimable? Here are some common goods and.

Fortunately, hm revenue and customs, the uk tax man, has provided a useful guide for claiming vat refunds under the vat refund scheme. May 28, 2023 understanding value added tax (vat) and knowing how to claim it back can. From 1 january 2021, eu businesses that pay vat on expenses in the uk will be required to make a claim under the provisions of part 21 of the above regulation.