Lessons I Learned From Tips About How To Claim Tax Repayment

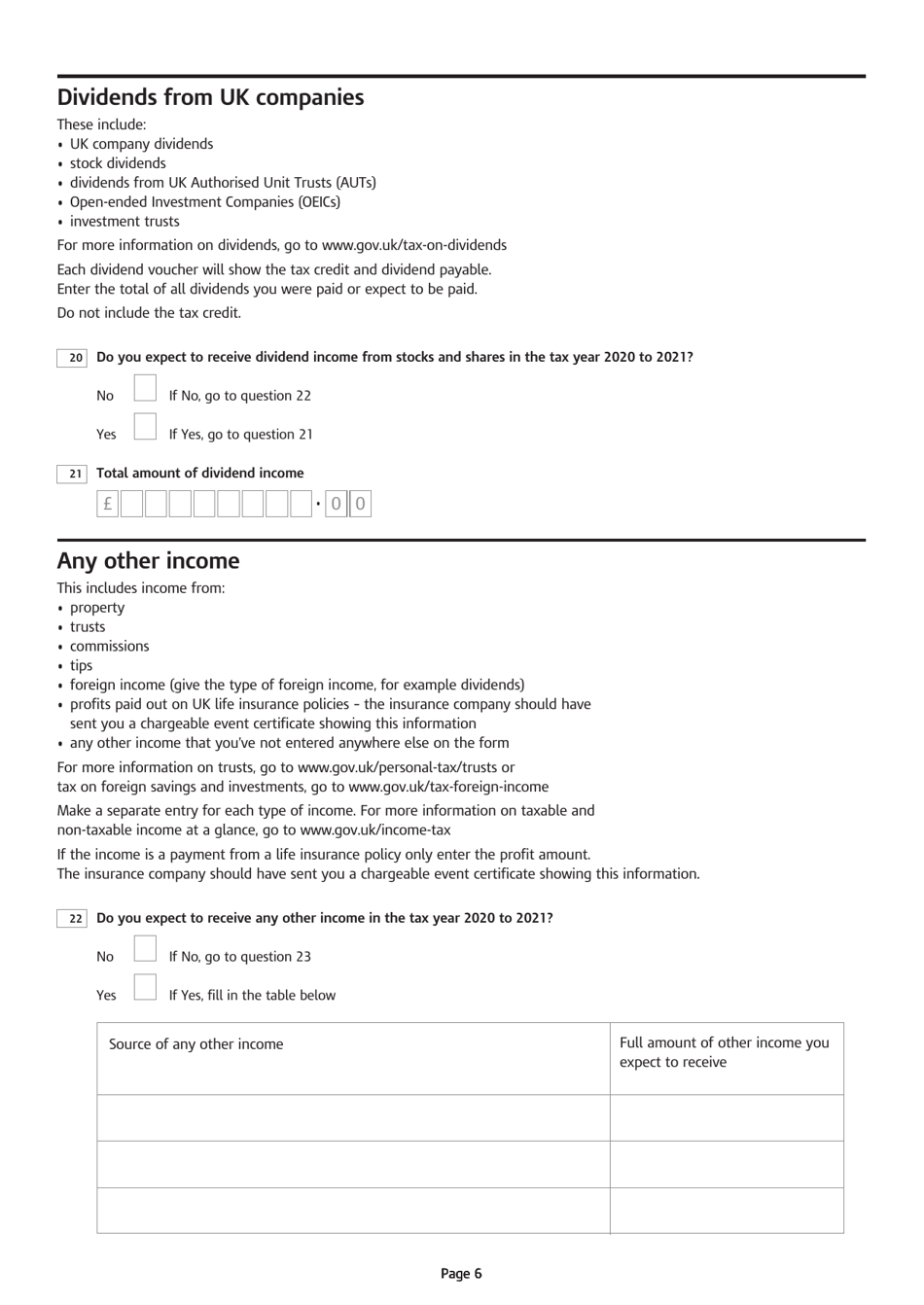

You may be able to get a tax refund (rebate) if you’ve paid too much tax.

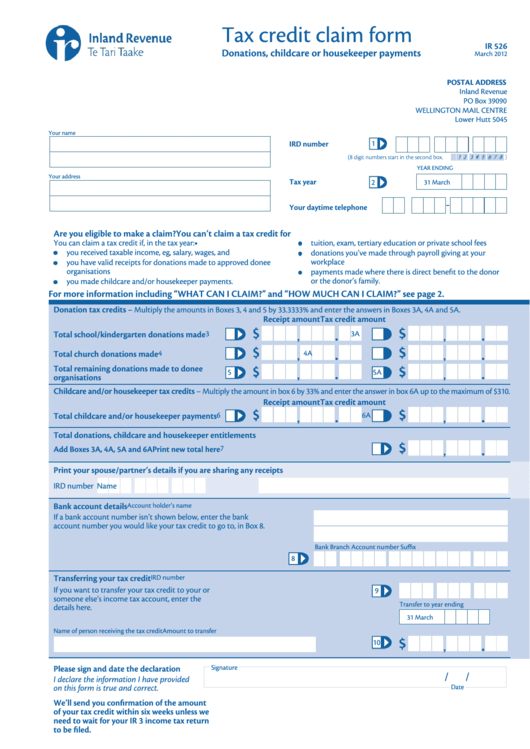

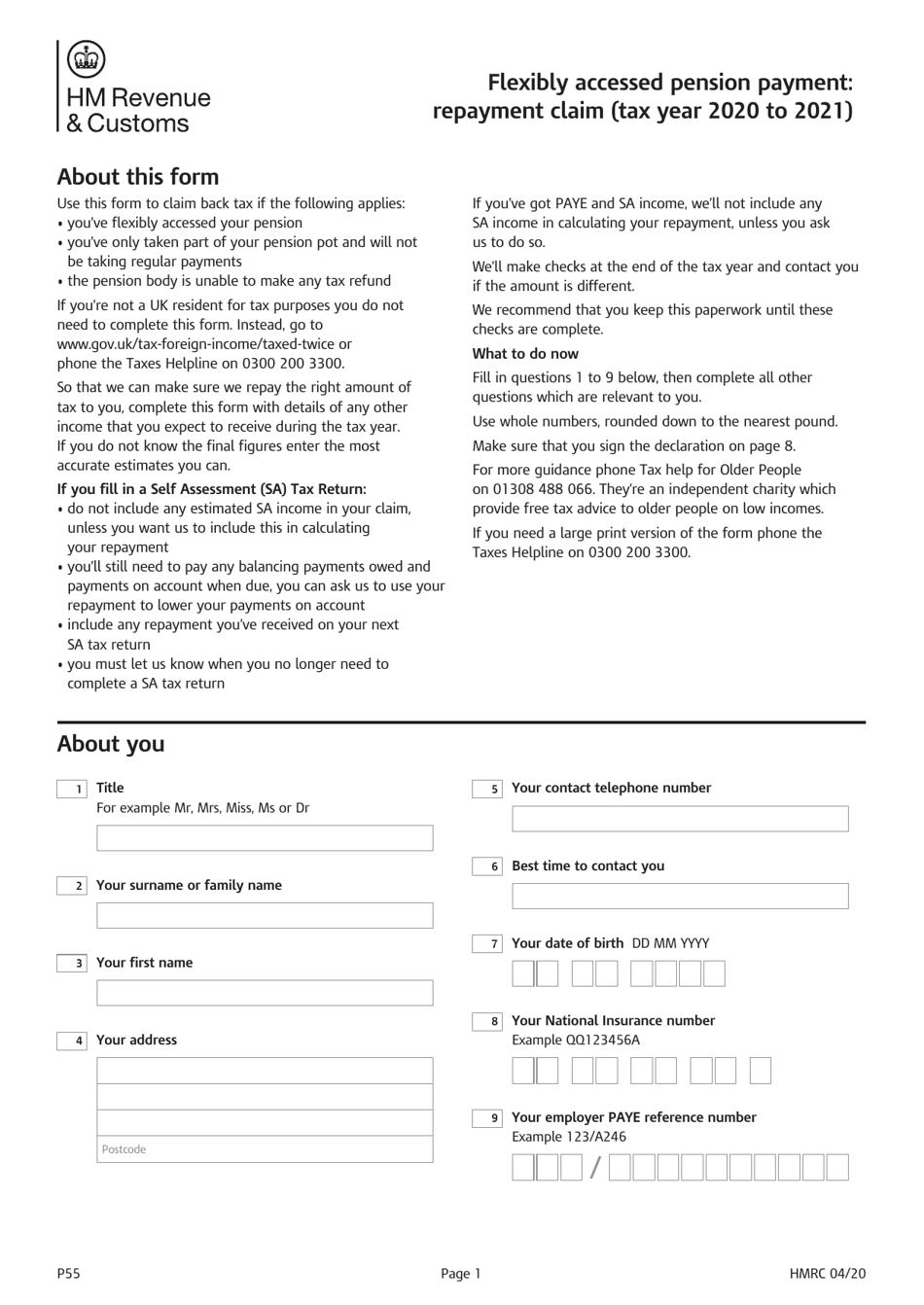

How to claim tax repayment. Tax that they have overpaid will be returned directly to their bank. $13,850 for single or married filing separately. You can claim back any tax we owe you on a pension lump sum using p53 if you have taken:

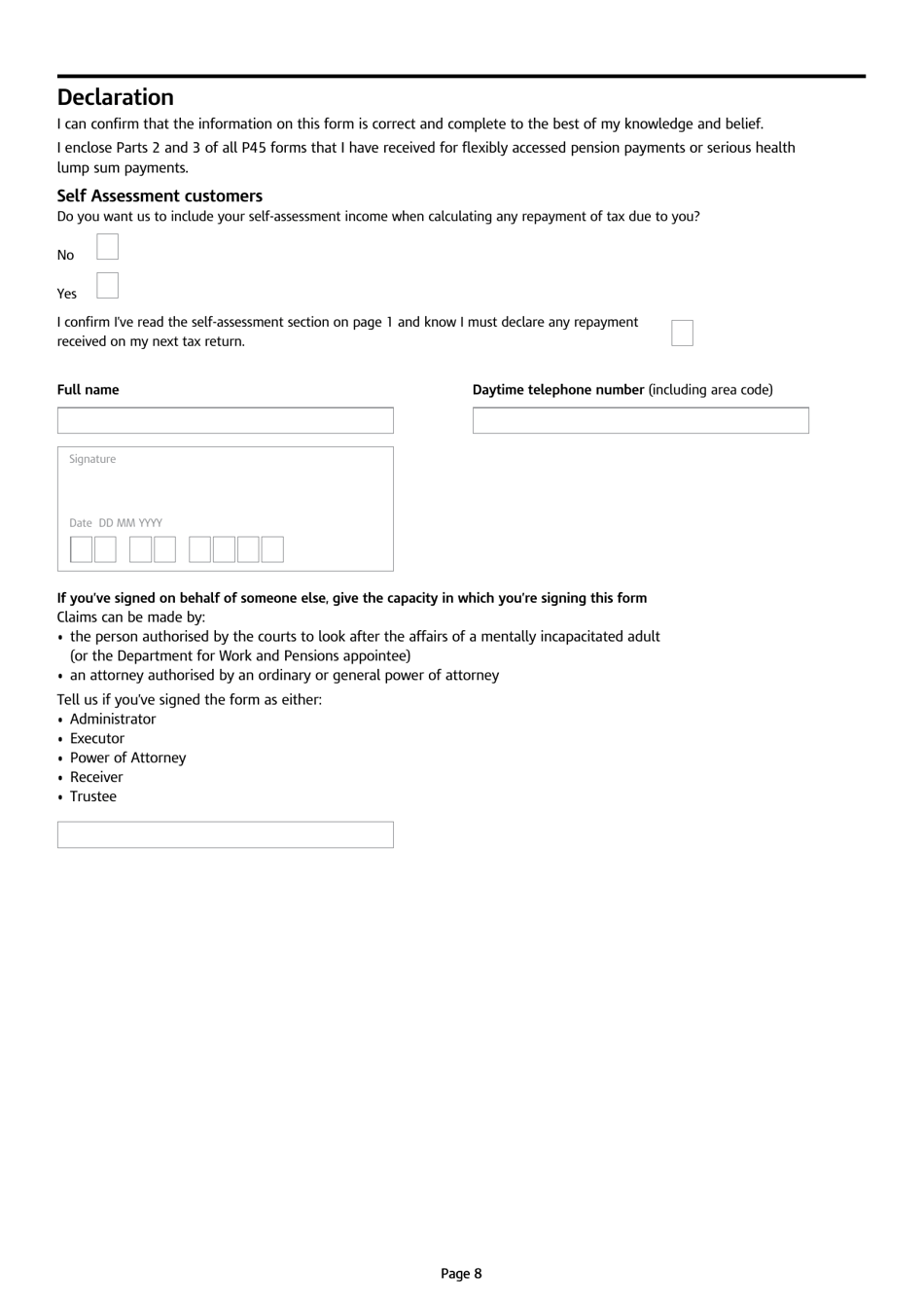

You’ll need to send the benefit office parts 2 and 3 of your p45 to claim your tax refund. Check how to claim a tax refund. A claim of right repayment is a deduction you can take in the current tax year if you’re required to pay back income in excess of $3,000 from a previous tax year.

Enter this amount on line 13000 of your 2022 return. The supplementary evidence required is either:. The standard deduction for 2023 is:

Repayment of covid benefits. Fixing the public service loan forgiveness program so that borrowers who go into public service get the debt relief they’re entitled to under the law. How does a section 1341 credit work?

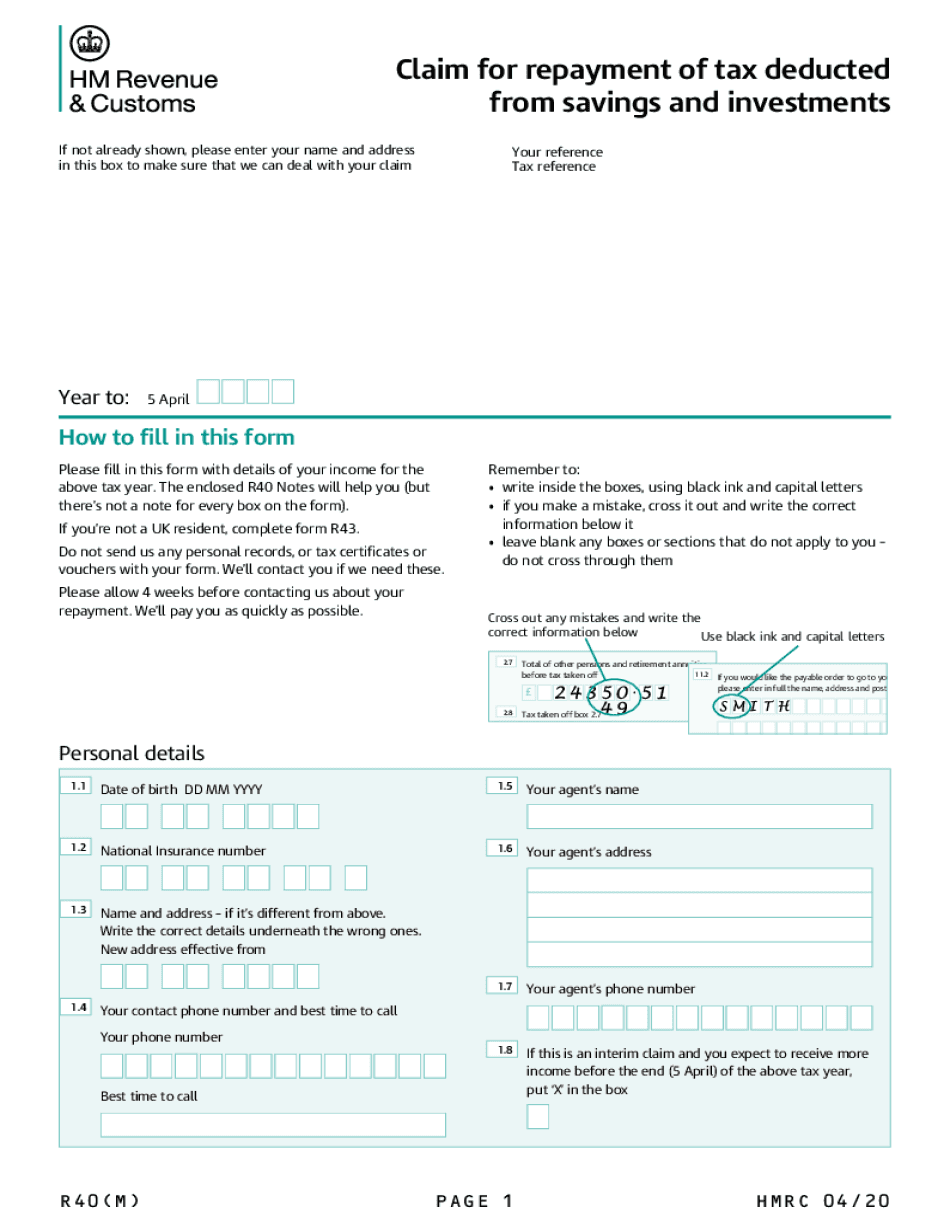

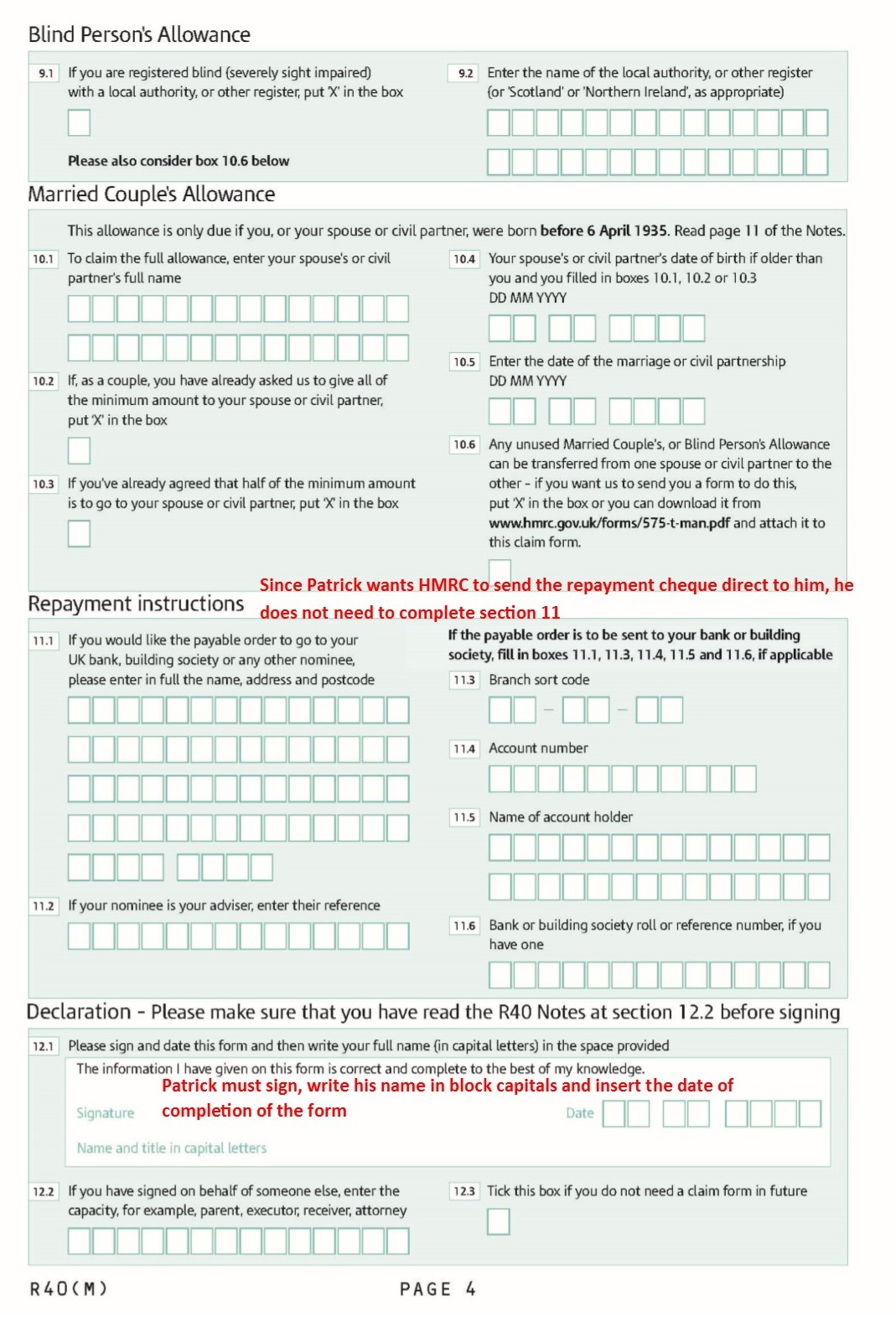

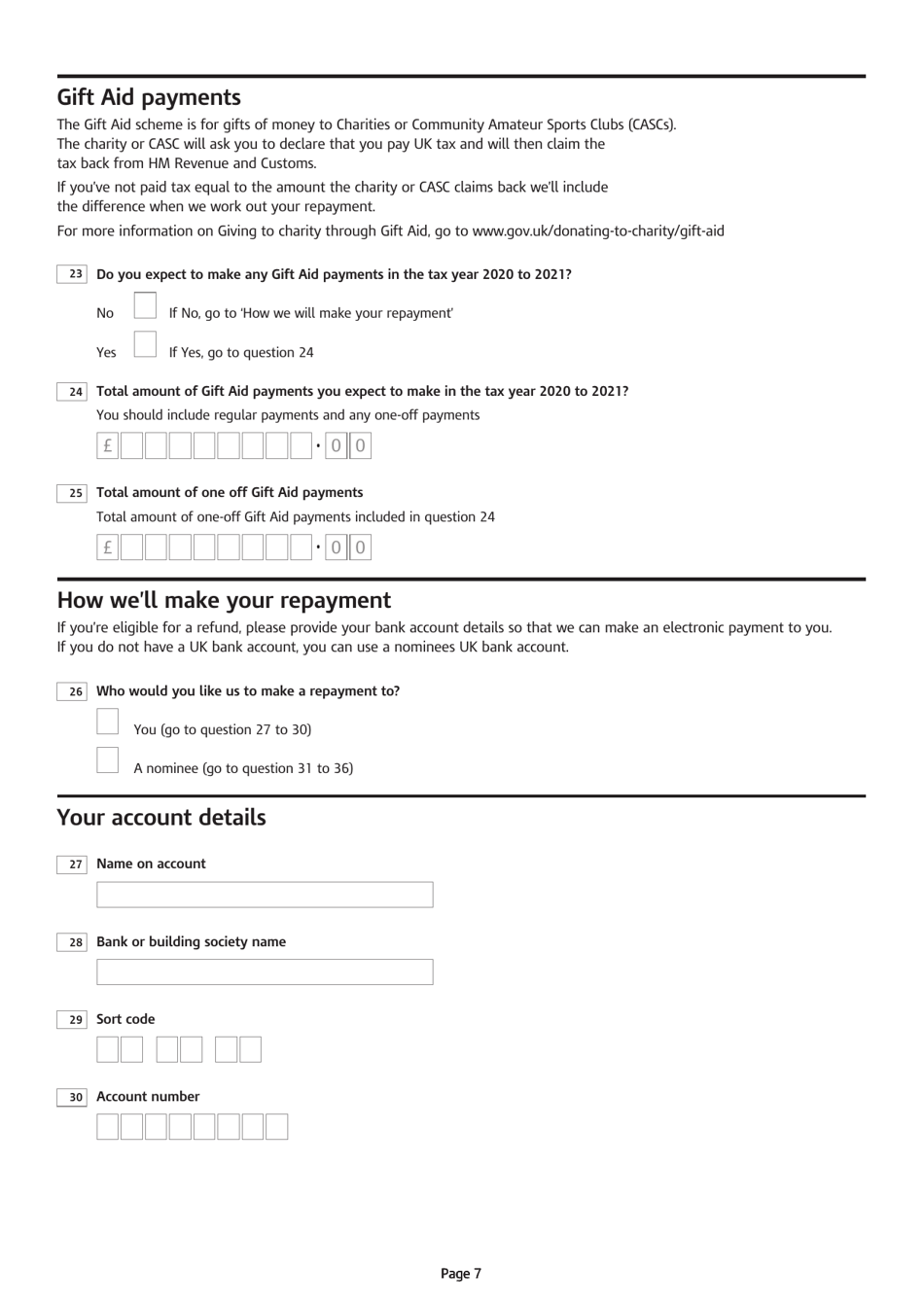

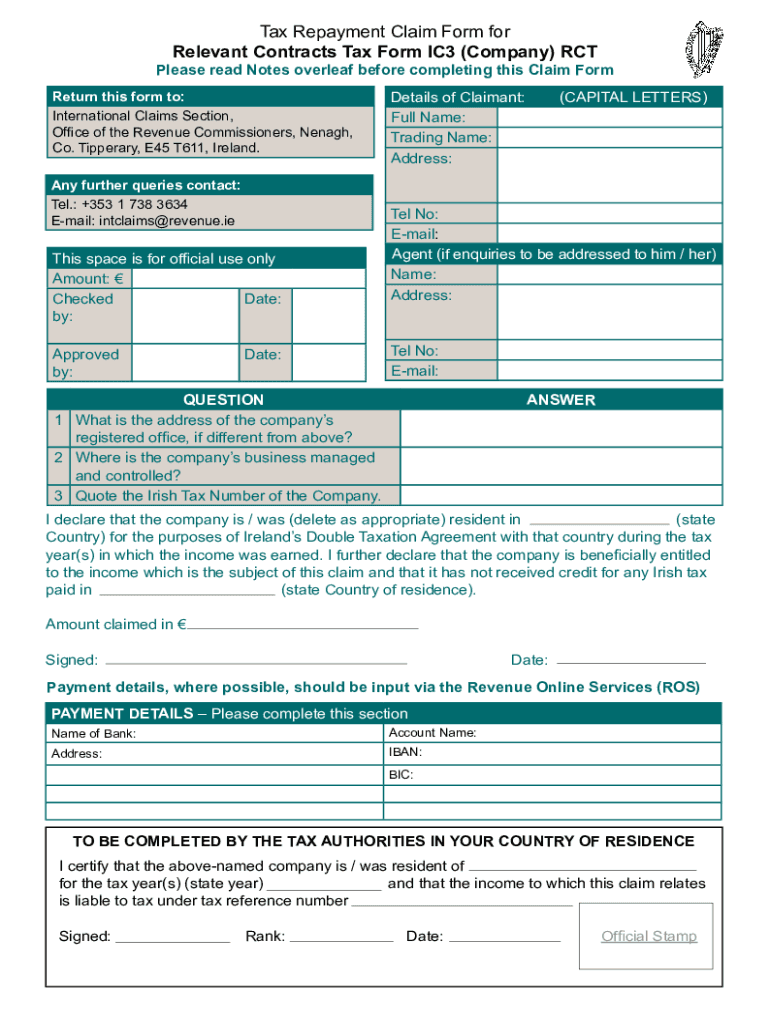

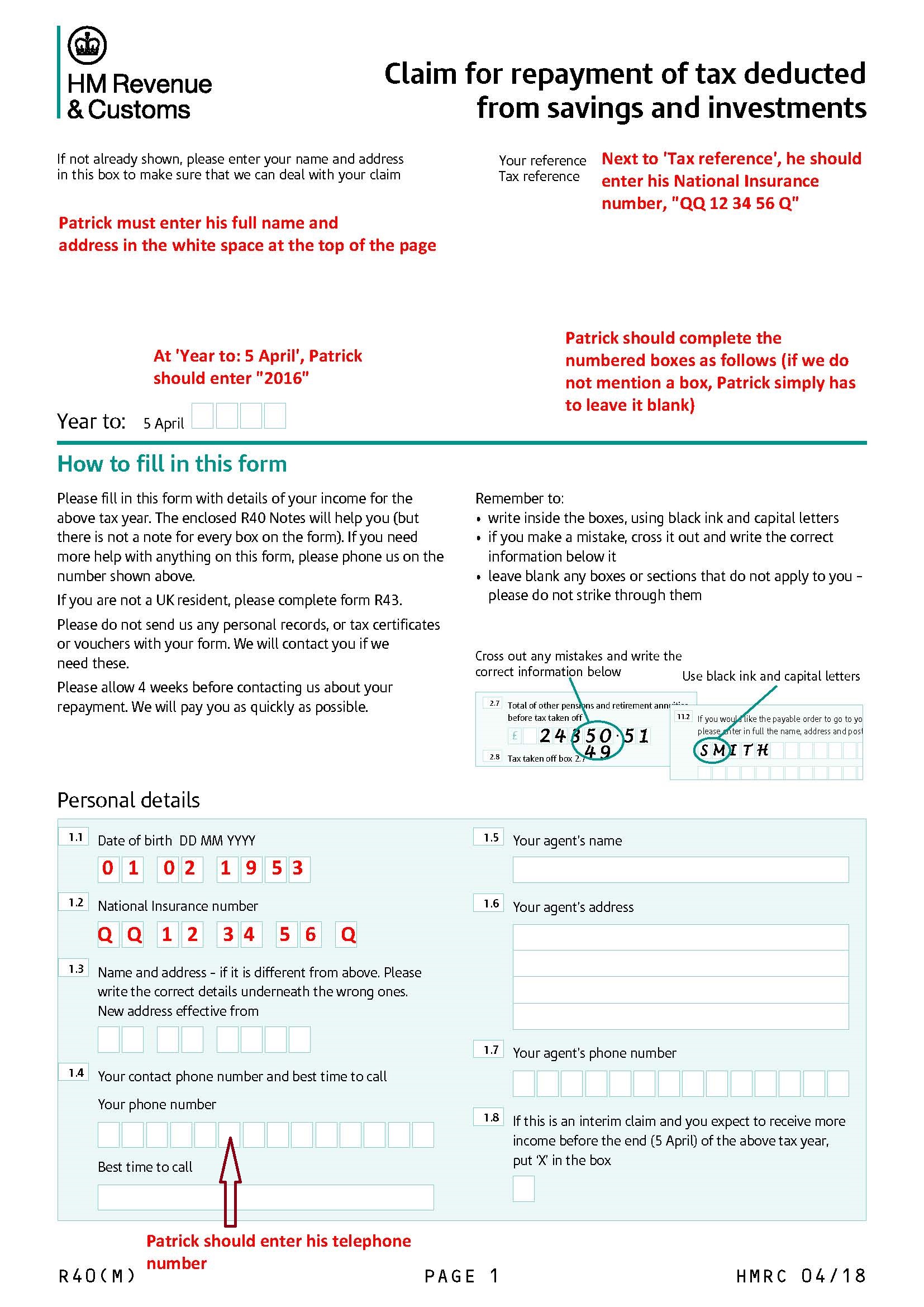

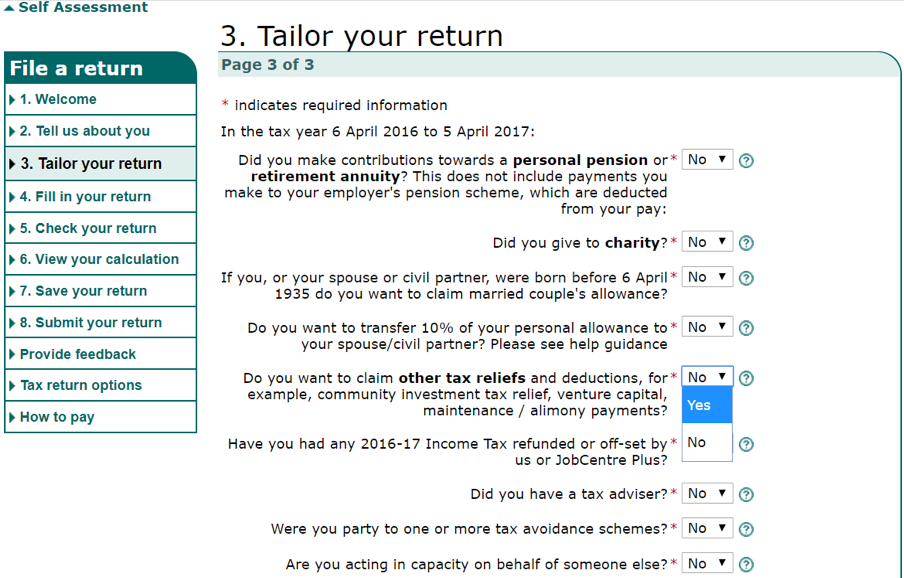

You can claim back tax from a self assessment tax return for a period of 12 months after the submission deadline of the 31st of january. Use this tool to find out what you need to do if you paid too much on: Taxpayers can claim any repayment on their tax, for free, from the hmrc website, which has a dedicated webpage showing taxpayers how to claim tax refunds.

They’ll work out your refund and pay it either. The number of people complaining to his majesty's revenue and customs about companies claiming tax repayments on their behalf has more than tripled in two. This is the regular period of.

The online tax refund service is available to customers who use their personal tax account. $27,700 for married couples filing jointly or qualifying surviving spouse. To find out more about the hmrc app on gov.uk.

Hmrc now require evidence of the ppi claim before they will progress a claim for repayment of tax deducted. All of your pension as cash — trivial commutation of a pension fund a. It’s important to keep part 1a for your records.

If you have not received a p800, you can still claim a tax refund by contacting hmrc directly through its online portal or by calling 0300 200 3300. How to claim a refund in the current tax year on an overpayment of tax when you've flexibly accessed part of your pension pot. If you repay a benefit amount after december 31, 2022, you can only claim a deduction in the year that you make the.

You can also use this form to authorise a representative to get. This video looks at how you can view, manage and update details and claim a tax refund using the hmrc app. Online tax software can help you complete your tax return to claim a tax refund for 2021 (you.